Home » Bequest Income Funds

Bequest Income Funds

Your Path to Consistent & Predictable Monthly Passive Income

Unlock steady growth

Our established evergreen investment funds that offer consistent and predictable monthly passive income with competitive returns.

Bequest Legacy Fund: Multi-Asset Strategy for Income & Growth

A diversified fund investing in real estate and energy assets – built for high yield, consistent returns, or compounding growth.

Bequest Income Fund: Predictable Monthly Passive Income

Simple, stable, and stress-free – monthly income backed by mortgage notes and real estate.

Simple, Stable, and Stress-free

Investment example: Invest with a Bequest Income Fund with $50,000 upfront, adding $2,000 monthly for fifteen years at 10% interest, will grow to over $1,000,000 in future value. Calculate your own scenario.

Future Balance

?

Total Interest

?

Total Principal

?

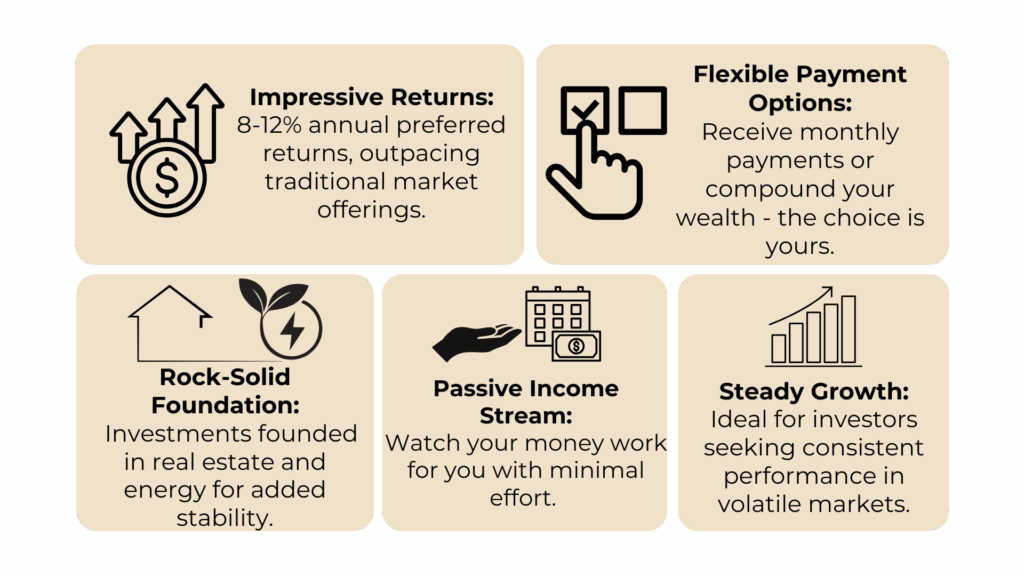

Why Choose A Bequest Income Fund?

Bequest Investment Funds FAQs

Bequest has been managing funds since 2014.

The minimum investment for a Bequest Income Fund is $50,000 and the maximum is $1,000,000 per EIN.

Per SEC guidelines, Bequest has two offerings available: Regulation D and Regulation A. The Bequest Income Funds are Regulation D funds that are only available to accredited investors. The Bequest Bonds are Regulation A bonds that are available to non-accredited investors but are limited to no more than 10% of the person’s annual income or net worth. For more information, click here.

You may submit your investment as a wire transfer or ACH. Please contact the Investor Relations team if you have any questions.

You may cancel your investment at any time, for any reason until 48 hours prior to a closing occurring. If you have already funded your investment, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment, please email bequestsupport@industryft.com

Yes, Bequest accepts investments from most other countries which an investor is able to verify that the investment is legal under their country’s laws.

For the quickest response, please send an email to invest@bqfunds.com. Alternatively, you can book a call here.

Yes, each Bequest Income Fund offers the opportunity for you to either (a) receive a monthly distribution (e.g. passive income) or (b) compound your interest for greater growth. Simply select which option you would like during the purchase.

Generally, an accredited investor, in the context of a natural person, includes anyone who: earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year. There are other categories of accredited investors that you may view here or on the SEC website.

Preferred returns are directly deposited into your account (via ACH) the 1st week of each month. Investors also have the option to compound the preferred return along with the initial investment and earn a greater overall return over time.

All investors will receive their monthly investor statement on or before the 10th business day after the end of each month.

If you invest, you become a part owner of the entire fund versus a specific asset held by the fund. Therefore, your capital is diversified across the entire portfolio.

Investors will receive their preferred return distributions on a monthly basis. Investor statements and Quarterly Newsletters will be issued on a quarterly basis.

An evergreen fund is an opened fund with no expiration date. We offer safe, reliable options for investors seeking long-term solutions to earn passive income.